Commercial landlords – How to avoid MEES penalties for energy inefficiency

We all need to reduce the amount of CO2 we emit. The government’s carbon reduction strategy sets out the minimum energy efficiency standards, called MEES, that affect privately-rented residential and commercial properties.

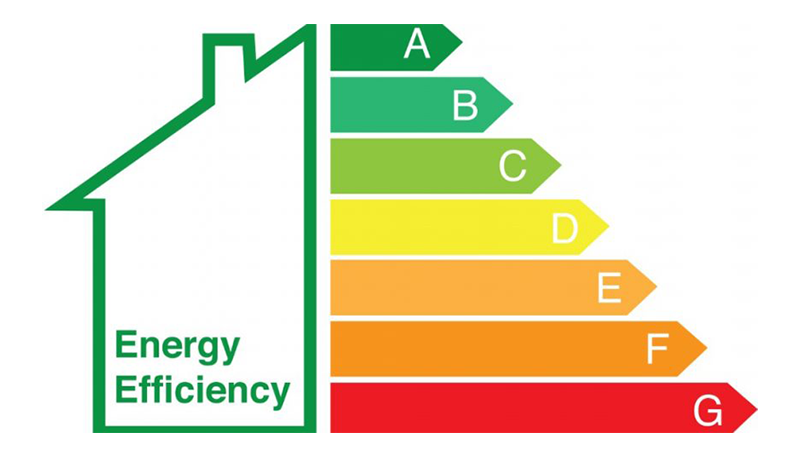

Landlords have had to arrange energy performance certificates for most let properties in the UK since 2008. This means, as a tenant, you know up front how much the place will cost to heat, as well as understanding how that cost can be reduced. From April 2018 it has been illegal to lease a property with an energy performance rating of F or G, unless you are exempt.

Do the MEES regulations apply to you?

If the property has an energy performance certificate or EPC, the MEES regulations apply. On the other hand some industrial sites, workshops and commercial agricultural buildings with particularly low energy use are exempt.

The age of the lease also matters. Is the property on a new lease or an existing one? Until April 2023 MEES only applies to new lettings and lease renewals, after which commercial landlords will need to comply with MEES for properties let under leases that started before April 2018, which are still in place in 2023.

The length of the let is important. Short tenancies of less than six months don’t fall under MEES unless there’s a lease renewal or extension, or the tenant has already occupied the place for 12 months in a row. If it’s a lease of 99 years or more, the MEES regulations don’t apply.

Maybe the property itself is exempt from MEES. The list of exemptions covers things like small, stand-alone buildings as well as those due to be demolished. Listed buildings are problematical right now, possibly intended for exemption but the legal wording leaves some wriggle-room. If that’s you, ask your solicitor to clarify exactly where you stand.

Now and again, the steps required to improve energy efficiency qualify for their own exemption, namely improvements that can be 100% paid for by the government’s Green Deal. On the other hand the Green Deal is currently under question, potentially due to be closed down or replaced by something else, so it’s wise to check.

If the energy saving steps require third party consent but you can’t get it, or you can only get things done under ‘unreasonable conditions’, you may be able to avoid those steps. You might also be able to avoid making improvements if an independent surveyor confirms they’re likely to reduce the value of the building by more than 5%.

If you turn out to be exempt you must register your exemption officially, after which it’ll remain valid for five years.

What happens when MEES applies to your property

When you own a non-exempt F or G rated property and you want to let it, you have to improve the energy efficiency rating to at least an E grade. If you don’t do so before the lease is granted, the lease can remain as it is but you risk a large financial penalty of anything from £5,000 to £150,000, depending on the value of the property and how long you take to address the problems. If you decide not to comply with the regulations your decision will be made public, which will damage your reputation.

More changes are due in future

There are stricter regulations on the way, in line with government plans to further reduce the nation’s CO2 emissions. Your place might not fall under MEES at the moment, but it eventually will. There’s no escaping it. Your best bet is to bite the bullet now, comply with MEES, and then you’ll be better prepared for any extra energy-saving measures you need to take in future.

Useful Links

https://www.gov.uk/energy-performance-certificate-commercial-property

https://www.gov.uk/energy-performance-certificate-commercial-property/exemptions